The Joshua Horton Law Firm is proud to announce its partnership with the Connecticut-based law firm Silver Golub & Teitell in pursuing a landmark class action lawsuit against Vision Solar and Dividend Finance Inc. This lawsuit aims to address the unfair and deceptive practices employed by these companies against homeowners across the country, particularly in Florida, where many of the plaintiffs reside.

A History of Deception: Vision Solar and Dividend Finance

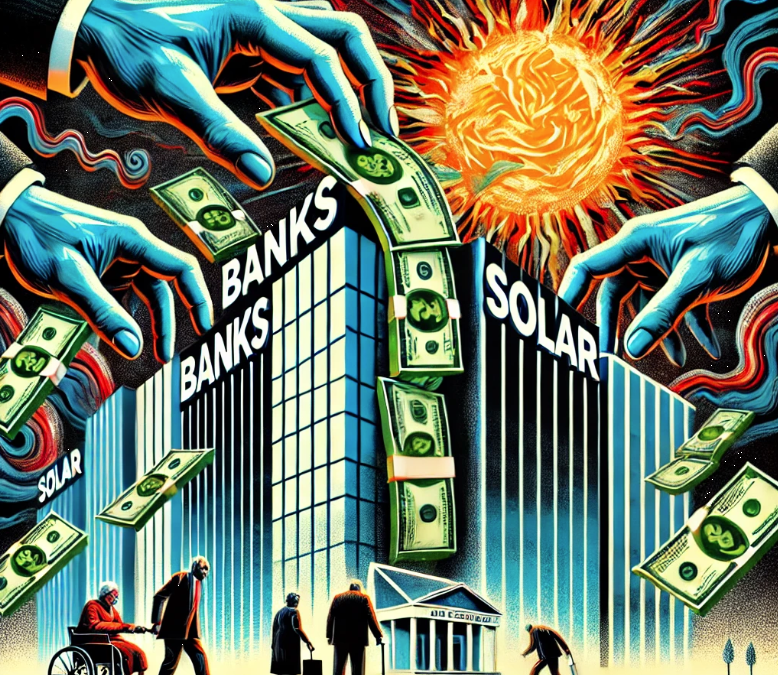

Since 2018, Vision Solar, a New Jersey-based solar sales and installation company, and Dividend Finance, a Delaware-incorporated lender now owned by Fifth Third Bank, have allegedly been working in unison to deceive homeowners into signing predatory loan agreements for solar panel systems. Vision Solar’s role has been to market and install solar panels, while Dividend Finance provided the loans to fund these systems. Together, they have employed misleading tactics to induce customers into unfair financing arrangements.

Fifth Third Bank, which acquired Dividend Finance in May 2022, has continued marketing Dividend Finance as a “division of Fifth Third Bank.” As alleged in the lawsuit, the deceptive actions of Vision Solar and Dividend Finance have harmed homeowners not only in Florida but also in Arizona, Connecticut, and Massachusetts.

Misrepresentation of Solar Panel Benefits and Financing

The core of the lawsuit focuses on the misleading claims made by Vision Solar and Dividend Finance regarding the benefits of solar panel systems. Homeowners were promised substantial energy savings, attractive tax benefits, and low-cost financing to encourage them to sign up for loans provided by Dividend Finance. However, these promises were built on a foundation of deception.

According to the plaintiffs, Dividend Finance dictated how Vision Solar should market and sell these systems, even going as far as providing training materials on how to close sales quickly. Sales presentations emphasized “low APR & low fee products,” while also encouraging sales teams to prioritize speed over accuracy, with slogans like “Focus on Selling, Not Fixing Paperwork” and “Sell, Close, & Go On To The Next One.” These high-pressure sales tactics were incentivized through rewards such as gift cards and prizes for meeting loan sales targets.

Unlicensed and Unpermitted Installations

One of the most egregious practices alleged in the lawsuit is Vision Solar’s failure to obtain the necessary permits and licenses to install solar panel systems legally. In many cases, Vision Solar did not even attempt to comply with local permitting and licensing regulations in jurisdictions such as Florida, Arizona, and Massachusetts. As a result, many homeowners ended up with solar panels that were never connected to the power grid and were therefore non-operational.

In the rare cases where permits were sought, Vision Solar allegedly used the credentials of licensed electricians who were not employed by the company at the time of the application, without proper authorization. These actions misled homeowners, who relied on written assurances from Vision Solar and Dividend Finance that all necessary permits and licenses would be obtained.

Seeking Justice for Homeowners

The deceptive practices of Vision Solar and Dividend Finance have had a devastating impact on homeowners, trapping them in predatory loan agreements for solar panel systems that were either non-functional or failed to deliver the promised benefits. The plaintiffs, represented by The Joshua Horton Law Firm and Silver Golub & Teitell, are demanding justice for these fraudulent actions.

This class action lawsuit seeks damages for the unfair business practices employed by Dividend Finance, Fifth Third Bank, and Vision Solar, as well as a trial to hold these entities accountable for their actions. Homeowners deserve compensation for the financial harm and emotional distress caused by these predatory tactics.

Conclusion

The Joshua Horton Law Firm and Silver Golub & Teitell are committed to standing up for the rights of homeowners who have been deceived by Vision Solar and Dividend Finance. If you or someone you know has been a victim of these unfair practices, it is important to seek legal counsel and explore your options for pursuing justice.

This blog post is for informational purposes only and does not constitute legal advice. Please consult with an attorney for advice regarding your individual situation.